IowaSeeds encourages Iowans to reinvest tax savings back into their communities

Contact: Mary Russell

Email: homegrowniowalove@gmail.com

Website: IowaSeeds on Substack: https://iowaseeds.substack.com/

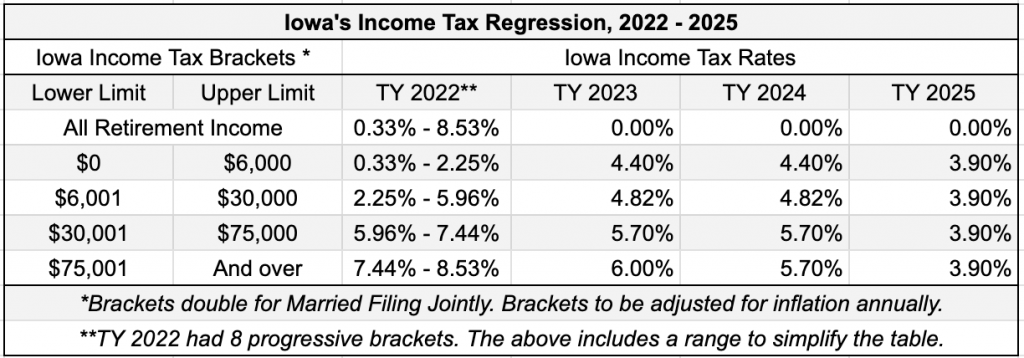

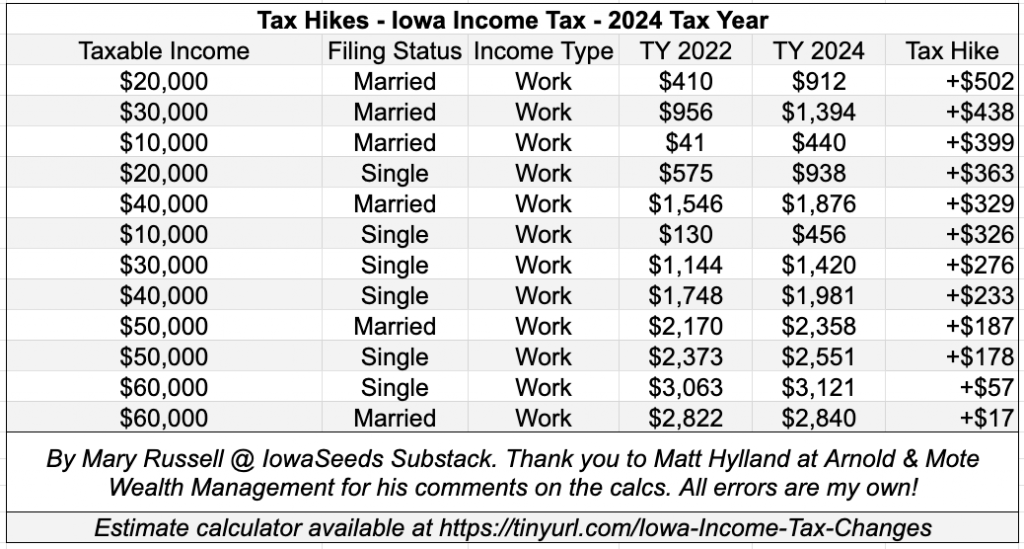

IOWA CITY, IA (April 25, 2025) – Tax Day for Iowans is April 30. Some Iowans will be paying more and some will be paying a lot less as a result of recent income tax changes in the State of Iowa. Iowa has raised taxes for low and middle income Iowans, significantly lowered state income taxes for high-income earners and eliminated (now 0% rates!) state income taxes on retirement income.

Iowans can use this online calculator from #IowaSeeds to estimate their tax hikes or tax cuts from the changes for the 2024 tax year compared to the 2022 baseline.

See tax tables below

[Link to source sheet for these calculations (also includes other tables and calculators). You are welcome to use and work with these calculations for your graphics.]

Taxes as Seeds

As tax burdens shrink for high-earners and all retirees, questions arise about what is being asked of lower- and middle-income Iowans-and what the long-term trade-offs will be for the state’s budget, infrastructure, and public services.

Mary Russell, Iowa City resident and author of #IowaSeeds on Substack, is calling for greater public awareness and discussion. “From my perspective,” she says, “these tax cuts reduce the state’s ability to invest in the state’s future.”

Russell compares income tax to agricultural planting: “When the state collects income taxes, it’s like gathering a portion of each individual’s harvest to plant the next year’s crops. These tax ‘seeds’ are meant to yield returns for all Iowans.”

As the state collects fewer “seeds,” Russell notes that it’s up to individual Iowans to shape our future together. “Those who have received a tax cut have the benefit of a “Seed Fund” to invest in our state’s future.”

Russell hopes that Iowans-especially those benefiting most from these tax cuts-will voluntarily reinvest in Iowa’s future through charitable giving, especially in areas such as clean water that have been neglected by the state’s leadership. “I’d rather have clean water than a tax cut,” Russell said. “But if I get a tax cut, then I choose to invest that in Driftless Water Defenders and other organizations building a future of clean water in Iowa.”

“Just as a tithe is a way to invest in the future, the income taxes we pay can be seen as seeds for the state’s growth,” says Mary Russell, founder of the initiative. “But as tax rates fall, it’s no longer the state that is planting those seeds. It’s up to each individual to decide where their ‘seeds’ will go.”

IowaSeeds: A Conversation About Our Future

The #IowaSeeds project is not a fundraiser-it’s an invitation to reflect, connect, and act. Through essays, data, and personal stories, Russell is encouraging Iowans to ask:

- What do you most appreciate about your life in Iowa?

- How do you envision Iowa’s future?

- Who is building that future-and how can you be part of it?

“Whether through volunteering, donations, or even paying taxes, Iowans have the power to shape their own future,” Russell says. “The key is to be intentional.” [Link to video – Momentum in Iowa’s Clean Water Movement – about volunteer organizing for clean water.]

Russell invites all Iowans to join the #IowaSeeds conversation by sharing their own stories of how they are investing their tax savings. “We’re at a crossroads as a state,” says Russell. “Now is the time to ask: What kind of Iowa do we want to build? And how can we contribute to it?”

Russell invites all Iowans to join the conversation on social media with #IowaSeeds or at #IowaSeeds on Substack, where she continues to share insights on Iowa’s tax policy and highlight stories of residents reinvesting their tax savings in their communities.

IowaSeeds in Action

The initiative highlights various ways Iowans can invest their tax savings, from donations to local non-profits like Feed Iowa First and Driftless Water Defenders, to financial investments in Iowa-based banks and businesses. It also showcases personal stories, such as Trista Carlson of Edge Realty Group in Iowa City, who has committed to giving back through donations to the Iowa City Community Theater.

“These tax savings are an opportunity to give back, not just at Giving Tuesday, but every payday,” says Carlson. “It feels good to contribute to the things that make Iowa a great place to live-like local arts, education, and food security.”

-30-

About Mary Russell

Mary Russell lives in Iowa City. She attended the University of Iowa College of Law where she worked as a tax law research assistant to Professor Larry Ward. She created #IowaSeeds to demystify Iowa’s income tax changes and to inspire Iowans to take an active role in shaping the state’s future.

To download full image, right click and select Save image as